Make Your Kids Tax-Free Millionaires

Yep, you read that right… Tax – Free – Millionaires.

And that's not even the only good news… You can lower your taxes in the process AND educate your kids. Talk about a slam dunk!

Let's take a look at how this is possible and what steps to take to make it happen.

Turn an Allowance into Tax-Free Wealth

So, how can you make your kids tax-free millionaires? Pay them!

However, do so in the form of wages as an employee instead of an allowance for doing household chores. There are two criteria that need to be met in order to implement this strategy.

First, you have to run a business; if you're strictly an employee, it won't work. However, if you're any of the following, you can put this plan in place:

- Self-employed

- Business owner

- Investor*

- Employee with a side business

Second, you have to have kids. Shocking, I know. Assuming you fit the bill, you can pay your kid(s) any amount you want but, for the purposes of this article, we’re going to stick to a completely tax-free, tax-advantaged method.

Tax Advantages for Both You and the Kids

Let’s break down exactly how this is such a tax-friendly method of transferring wealth to your children. The idea is to pay your children wages up to the amount of their standard deductions.

What’s a standard deduction? In simple terms, it’s an amount (set by the IRS) of an individual’s income that is exempt from tax. Each individual is afforded a standard deduction; the amount depends on your filing status. In 2017, the standard deduction for a single taxpayer was $6,350. As a result of the Tax Cuts and Jobs Act, the standard deduction has nearly doubled to $12,000 for single taxpayers in 2018, amplifying the benefits of the “pay your kids” strategy.

With this in mind, you can pay each kid up to $12,000, completely free of income taxes.

They may be able to avoid payroll taxes, too. If your children are under 18, they are exempt from the dreaded FICA taxes (Social Security and Medicare), provided that the business is a sole proprietorship or partnership and the owner of the business is one (or both) of their parents. If the employing entity is a corporation or there is a non-parent owner of the business, FICA taxes must be withheld. Children under 21 are exempt from federal unemployment tax (FUTA) under the above circumstances, as well.

The best part? You can deduct 100% of wages paid to your children as a business expense, effectively lowering your taxable income and, therefore, tax liability.

That’s right – you get a tax deduction and they get tax-free income. If that’s not a win-win, I don’t know what is.

What’s All This “Millionaire” Talk?

“Nick, you said I can make my kids millionaires but I can only pay them $12,000 each per year? That will take 83 years to reach a million bucks!”

– Every reader with a calculator

Good observation – I did say both of those things. But I have one more trick up my sleeve…

Have your kids invest their earnings!

The best course of action for your kids to take with their salaries is to contribute to a Roth IRA. There is no age restriction with respect to who can open a Roth IRA; the individual just needs to have earned income to contribute. The contribution limit (at the time of this writing) for each individual is $5,500 per year. Remember, Roth IRA contributions are made with after-tax dollars (even though income tax will be $0 for your kids in this scenario). Therefore, all contributions and earnings can be withdrawn tax-free in retirement.

Assuming each kid makes $12,000 and contributes $5,500 to a Roth IRA, that leaves $6,500 to save, invest, or spend however you see fit.

Teaching Your Kids Life Lessons

Aside from the monetary advantages, hiring your kids allows you to teach them about work ethic, running a business, earning and investing money, the value of a dollar, and taxes, among other things.

Involving your kids in the day-to-day activities of your business educates them on how a business is run and the importance of entrepreneurship. It’s much easier (and, hopefully, more fun) to learn through experience rather than listening to your boring ol’ parents go on and on about business, investing, and taxes.

Explain to your children that you are paying them for the work they are doing. They should understand that they are being paid an hourly wage for their services and, at the end of the year, they will have earned $12,000.

Break it down dollar by dollar. Let them know why a Roth IRA is a phenomenal investment strategy and how it can benefit them to max out those contributions. Tell them it’s okay to take a portion of their earnings to use as “spending money” but explain why it’s important to invest as opposed to spending all of it.

Make it clear that if they want to buy anything (toys, candy, apps for their phone/tablet, etc.), they will have to pay for it with their own, hard-earned money.

Even if they are earning this money tax-free, you can become the de facto IRS and collect “income taxes” solely for the purposes of teaching your kids how taxes work (and how much they stink). You can obviously invest the collected “tax” money for them as previously described; it’s the lesson that’s important here.

Let’s put some numbers to the strategy in the following example…

Example Tax Strategy

Mike and Ashley are married with three kids – James (age 11), Sara (age 8), and Ryan (age 5). Mike is a full-time real estate investor who manages a portfolio of rental properties owned by him and Ashley. Ashley is a nurse at the local hospital, earning wages as an employee. Ashley also owns and operates a side business selling jewelry online with her friend.

Mike and Ashley’s rental portfolio earns taxable income in excess of depreciation, so they have been looking for ways to lower their tax liability. They also want to bolster their savings for their kids’ college education.

After meeting and consulting with their CPA, Mike and Ashley learned they can pay James and Sara as employees; the IRS has previously accepted a 7-year-old as old enough to be an employee of his/her parents, generally concluding that a child under the age of seven is too young to work. Therefore, Ryan will have to wait a few more years before getting his first job.

Ashley could hire James and Sara as employees of her jewelry business but, since her friend is also an owner of the business, the children would not be exempt from FICA taxes. They soon realized that the best strategy is to hire them as employees of their real estate investing business, helping out with day-to-day tasks.

Mike and Ashley paid James and Sara each $12,000 over the course of the year. Each child opened and contributed $5,500 to a Roth IRA, set aside $1,500 for spending money, and invested the remaining $5,000 in stocks. There are better, more tax-advantaged investment strategies for the leftover $5,000 but, for the sake of simplicity, let’s stick with stocks.

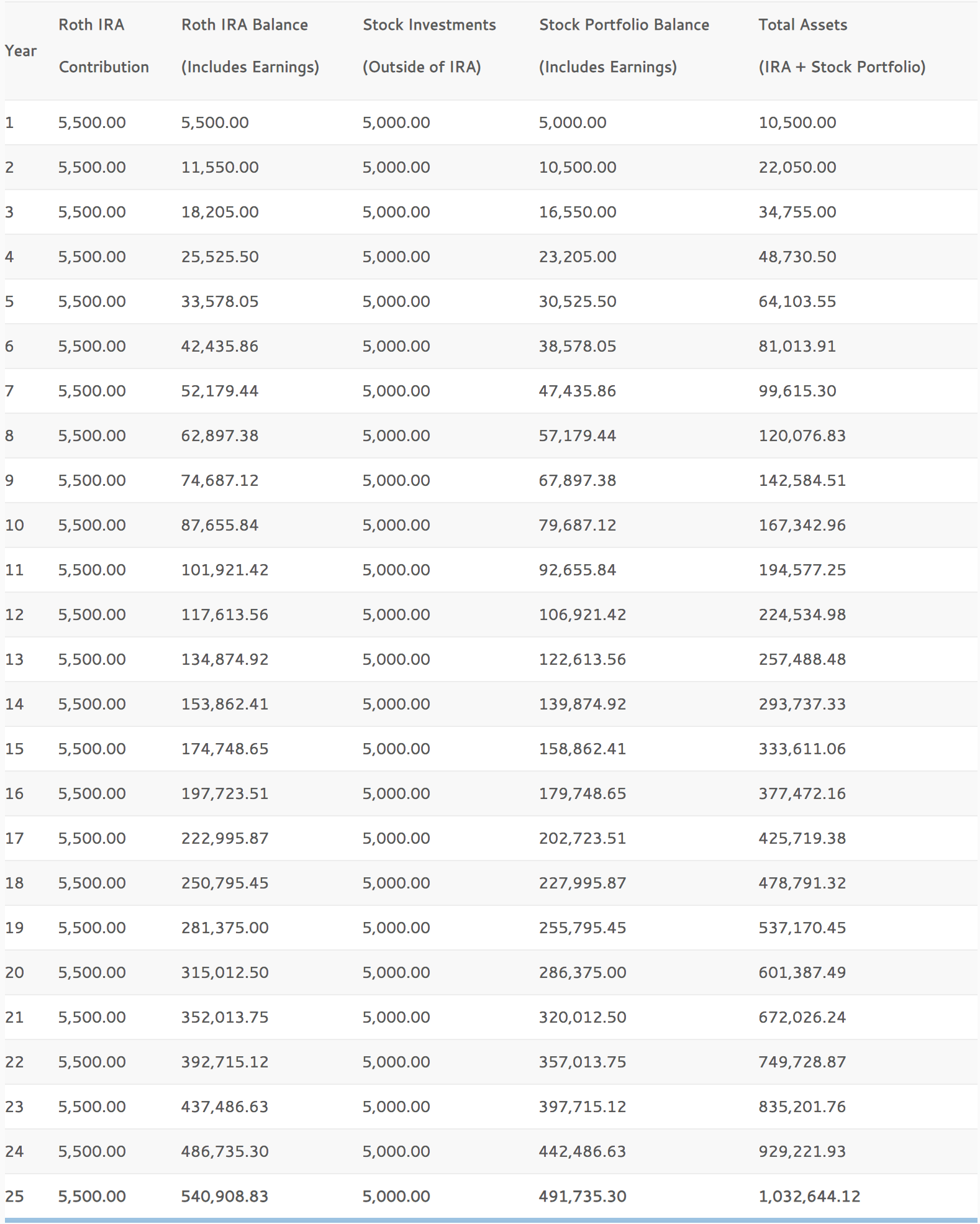

Historically, the stock market shows an average annualized return of about 10%. Below shows a table of James and Sara’s investments, compounding at 10% annually:

A couple things to note here – this assumes that the $5,500 Roth IRA contributions are made in full, once a year, and that the 10% return compounds annually. The $5,500 annual contribution can be prorated and made on a monthly basis and, realistically, the earnings will likely compound more frequently than yearly. Also, once James and Sara turn 18 or begin entering the workforce on their own, Mike and Ashley may abandon this strategy, but the table above assumes they will continue the same investing habits (again, for simplicity).

All that said, as you can see, each child will have grown a portfolio of over $1 million in assets, completely tax-free**. Furthermore, the Roth IRA will continue to grow tax-free until retirement.

Tax Strategy Recap

Hiring your kids is an excellent strategy for transferring wealth to the next generation with a host of tax benefits. As we covered, the main benefits derived from employing your children are:

- Tax-free earnings for them

- Tax deduction for you

- Experience and knowledge gained from working in a business, making money, and investing at a young age

If you have kids and run a business, reach out to a tax pro who can help you implement this strategy ASAP.

*Think along the lines of investors in real estate or other businesses, not casual stock market investors.

**For purposes of this example, we are ignoring tax on investment income (dividends, capital gains, etc.) on the stock investments outside of the Roth IRA. As I mentioned, other investments can be made that do not generate taxable income like this but the structure of such investments for a minor is beyond the scope of this article.