8 Critical Steps To Practicing Safe Syndications

The key to becoming a great real estate syndicator is to understand that your main job is to put the pieces of the syndication puzzle together. Whether it is branding, cultivating relationships with potential investors, recruiting your team, conducting due diligence, contract negotiation or securities compliance, your job is to act as the syndication quarterback and ensure that all of the moving pieces interact smoothly.

The purpose of this report is simple. To help you, as the syndicator, understand how the legal piece fits into the overall syndication puzzle. Since you are not a technician, you don’t need to understand every statute, regulation, or details of the federal and state securities laws. That is what your attorney is for. But it is critical that you have a basic understanding of the concepts so you can have an intelligent conversation with your attorney and be able to ask the right questions.

After all, if you want better answers, you need to ask better questions. So following are the 8 critical steps to practicing safe syndications. (I added a bonus number 9 since compliant websites have become a hot topic lately.)

Step 1. Determine Whether You Are Issuing a Security.

If you are issuing securities, then you must comply with all of the Federal and State Securities Laws. Period. Sounds simple, right? Well … the securities laws define a security in extremely broad terms and do not just cover what we typically think of as a security.

Most people think of a security as stocks, bonds, mutual funds, LLC Membership Interests, etc. But the definition of a Security is much broader and covers everything from profit sharing agreements, tenant-in-common agreements, promissory notes, handshakes, side agreements.

The actual structure of your syndication actually does not matter when determining whether you are issuing a security. This is why I like to use the following ‘cheat sheet’ to determine whether you are dealing with a security or not. Any time you are taking other people’s money where the returns are generated primarily from your efforts and the person who gave you their money has an expectation of a return, then you are dealing with a security.

In other words, if your investors are passive and just waiting for you to hand them money, you are issuing a security. This is true whether you have one investor or one hundred investors.

Of course, if you only have one or two other investors, it may be possible to make them an active participant in your company such that the returns are generated from the collective efforts of all the partners. That may result in you starting a business with business partners rather than issuing a security. This is why seeking the guidance of an experienced syndication attorney, early in the process, is critical to ensure that you are properly structuring your syndication to minimize compliance issues. (See Step 3).

Step 2. Set Up Your Syndication Business

We will discuss asset protection in Step 5, but first you must create the company under which you will run your syndication business. I call this your Sponsor Company. This is the face of your brand, if you will.

When you hand out business cards, you will be the founder and CEO (or whatever) of this Sponsor Company. When you build a website, the website will be under this Sponsor Company. When you are ready to get into contract on a property, this will be the entity that enters into the letter of intent and purchase contract (with the ability to assign it to the LLC that will ultimately own the property once you pass the due diligence stage).

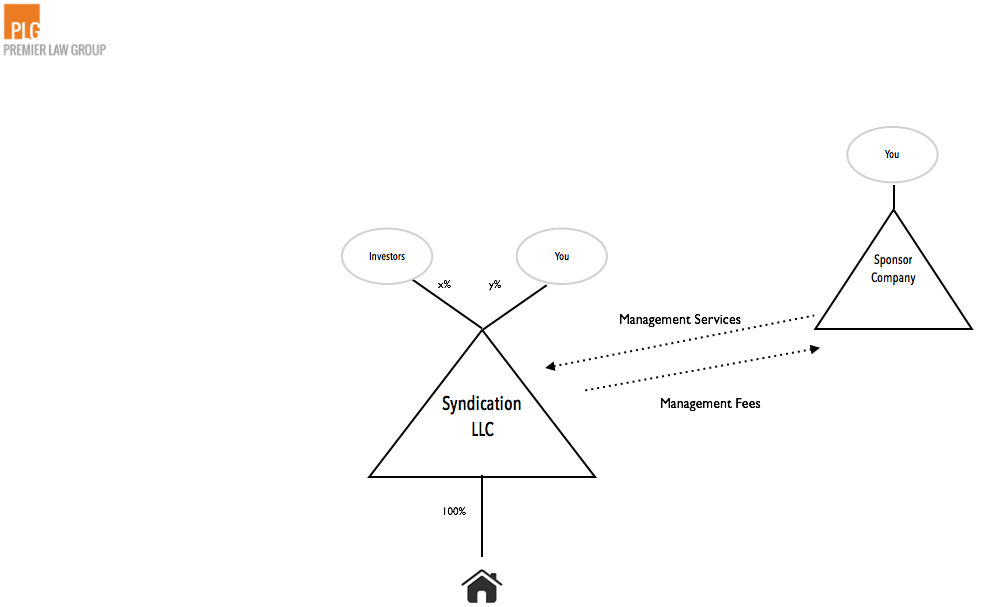

In the diagram below (Fig. 2.1) you will see that the Sponsor Company will most likely be a limited liability company (LLC) and be formed in the State where you live and where you will be conducting your business.

(Fig 2.1)

This entity will hold no assets and simply act as the sponsor of all of your syndication deals and also act as the manager of your syndication LLCs (the LLC that actually owns the asset and houses all your investors). It will, therefore, generate quite a bit of management fees from your syndication LLCs. Talk with your tax advisor on how best to have your Sponsor Entity taxed. In my experience most will make either an S or C Election.

Step 3. Meet With Your Legal Advisor

Meeting with your legal advisor very early in the process, sets the foundation and the tone for the rest of your syndication timeline. And in the event that you can structure your syndication as to avoid being considered a security, meeting with your attorney as early as possible is critical.

If you check-in with your legal advisor too late, then, at worst, you may have already violated securities laws, and at best you may have limited your options moving forward. For example, if you decided to blast your project out on your public Facebook page, you may no longer be able to accept non-accredited investors in your deal.

So contacting your legal advisor early is critical. How early? If you are purchasing a specific property, then as soon as you have an LOI and/or you are reasonably certain you will be contracting on the property, it is time to call your attorney. If you are putting together a blind fund, where you will not contract properties until after you have raised the funds, then contact your attorney as soon as you have made the decision to move forward with a fund.

Assuming you are dealing with a Security, then during the initial meeting, the main focus will center around understanding that there are only 3 things we consider when you are issuing a Security. Either 1) we must register your security with the Securities and Exchange Committee (SEC); 2) find an exemption to registration or 3) it is illegal.

We clearly are not in the business of conducing offerings that are not in full compliance of the Securities laws. If you conduct an illegal offering, at best you will be personally guaranteeing the return of your investor money and likely be prohibited from conducting raises in the future; at worst, you could be facing jail time.

Similarly, we like to avoid registration at all cost. Why? Because it will cost 6 to 7 figures in compliance costs and take 1-2 years to get your registration through the system. Now who has that kind of time after they enter into a purchase contract?

So we always look for the best securities exemption available, and luckily for us, there are a few exemptions that are responsible for 95% of the exemptions.

Step 4. Select and Abide by the Correct Exemption

Although there are numerous exemptions available to us, we will briefly discuss only Rules 506(b) and Rule 506(c) as over 95% of the syndicators rely on this exemption. Why are these exemptions so popular? 2 main reasons: First, they provide a safe harbor for the syndicator which means that if we comply with each element of the rule, then we are assured that we have complied with the exemption. Certainty is always preferably in an otherwise uncertain legal world. Second, they pre-empt State Law. This is just a fancy way of saying that we don’t need to worry about the State securities laws because the federal laws override or trump the state laws.

The importance of this point can not be overstated. If no pre-emption existed, we would need to hire a separate securities attorney in each State where you sold securities, which would make the compliance process more time consuming and costlier than it already is.

There is one important exception to pre-emption. The States still have jurisdiction over Anti-Fraud provisions so if you commit fraud or make material misrepresentations, the States will have a say.

Whether you use a 506(b) exemption or a 506 (c) exemption will depend on whether you plan to do any general advertising or generally solicitation with your offering. If you plan to advertise, you will be limited to using 506(c) only. If you plan to keep your offers to the people you already know and have a substantive pre-existing relationship, then you may rely on 506(b).

Below in figure 4.1 below, I have outlined the elements you need to satisfy for each rule in a compare and contrast format.

(Fig 4.1)

Step 5. Structuring Your Syndication for Maximum Protection for You and Your investors.

As a former asset protection attorney, I have had the pleasure of setting up hundreds of entity structures to maximize asset protection. Asset Protection lawyers often ask audience members at seminar presentations 2 simple questions. First, “how many of you have been sued before?” Typically, about 1/3rd of the hands go up. Second, “how many of you have not been sued yet?”

As you may know, unfortunately we live in the most litigious country in the world with nearly 1.4 million lawsuits filed every year. That’s about 116,000 lawsuits a month; 3,800 a day; 160 per hour; or 2 ½ lawsuits every minute!

Not to mention we have the most lawyers per capita: 391 lawyers for every 100,000 people living in the U.S. Compare that to Japan that has only 23 lawyers per 100,000, Canada which has 26 or France which has 72. And it’s not getting any better. It is estimated there are over 100,000 students in law school right now.

All this results in the unsettling reality that if you are in the business of syndicating real estate deals, you have a one in three chance of being named a Defendant in a lawsuit in the next year. This is why asset protection should no longer be viewed as a luxury or an option to consider, but rather smart business planning that has become a virtual necessity, just like any other form of insurance.

Why Not Insurance?

Insurance has traditionally played an important role in asset protection. And it should continue to do so. I always advise clients to use insurance as their first line of defense. But is it enough? The answer is quite simple: No. Limitations on insurance policies often provide the insured with a false sense of security, which is not recognized until it is too late.

For a more detailed analysis of insurance limitations, check out my Asset Protection report here.

Goal of Asset Protection

The goal of asset protection is two-fold: to protect you and your investors from your assets and sometimes more importantly, to protect your assets from you. The former is more aptly called limitation of liability because it limits (or contains) the liability to the entity that is being sued. For example, if something happens to your syndication property, you can limit your and your investors’ liability to whatever is contained in that company (usually the equity in the property) and prevent the liability from spreading to other assets you and your investors might own.

But what happens if something takes place that is completely unrelated to your business or assets? For example, what happens when you get into a car accident and cause severe harm to the passengers in the other vehicle? What happens when there is a judgment against you personally for causing that harm? Well then our goal is to protect your hard earned assets, including your portion of the syndication assets, from yourself.

These 2 goals must always be kept in mind when developing an asset protection plan.

Step 6. Draft Your ‘One-Pager’ and Business Plan

The ‘one-pager’ and Business Plan are essential marketing tools to sell your offering to potential investors. They also lay out your business plan and projected returns for your prospects. The attached article, “How to Write an Executive Summary” written by Eric Markowitz is an excellent starting point.

The key is to understand that the one-pager is designed to get your prospective investor to request more information and read the Business Plan. The Business Plan is designed to get your potential investors sufficiently interested to either want to talk to you in person or request the Private Offering Documents and write you a check.

Unlike most syndication attorneys, we spend quite a bit of time working with our clients on the Business Plan. Even though it is not a legal document, we underwrite every deal and meticulously go through the initial draft of the Business Plan. It is not uncommon for us to go through several drafts of the Business Plan before it is complete and ready to be sent out to your prospective investors.

There is no magic formula or template. Each Business Plan is unique and reflects the person drafting the documents and the intended audience. Having said that, here are some of the questions you should consider before drafting your executive summary.

• Will you be offering your securities to any non-accredited investors or limit your offering to accredited investors only? Offering your investment to non-accredited investors will require you to submit to all investors a Private Placement Memorandum with substantially more disclosures.

- If accredited investors only, do you plan on generally soliciting and generally advertising your syndication? You can now do this, but this is separate exemption and additional requirements will need to be met, including taking reasonable steps to verify that your investor is accredited. If you don’t, then you will want to have some kind of pre-existing relationship with your investor.

- What type of syndication will you be sponsoring?

- Project Specific

- A blind fund

- What is the “Problem” you are trying to address?

- What is the “Solution” you believe will solve this Problem?

- What is the specific Opportunity that addresses the Solution to the Problem?

- What is your competitive advantage?

- Who is on your Team and why are they the best people to lead this investment?

- What is the primary investment objective of the syndication?

- Cash Flow?

- Equity Growth?

- Rehab?

- Flip?

- Develop

- Target Hold Period?

- What kind of returns are you targeting for your investors?

- Are there any other Sponsors other than you in this syndication? If so, have you conducted your due diligence on them and made sure they are not “bad actors” that would prevent you from claiming the exemption to registration.

- What is the name of your Syndication, LLC?

- What is the name of the Sponsor Company?

- Will you use a holding company to hold your ownership in the syndication?

- What percentage of the Syndication do you plan to own and split with the investors? There will be 2 separate splits/compensation to consider: The split or compensation from the monthly or quarterly Net Cash Flow generated by the income of the Property; and the percentage equity interest in the Project when the project sells.

- Will you provide any sort of preferred return to the investors?

- How often will you distribute cash flow, if available? Monthly? Quarterly?

- What will the minimum investment be?

- Will any of your investors need to sign on the loan (if financing is required). If so, what type of additional compensation will you be providing them?

- What is or are your exit strategies. How long do you plan on holding onto the property? Do you plan to sell? Refinance? Options for exit for the investors?

- What is the stabilization period? Will you be returning profits to investors on day 1

- How will you be compensated?

- Acquisition Fee

- % of the cash flow

- Asset Management Fee

- Back-End equity participation

- Disposition Fee

- Re-Finance Fee

- Property Management Fee

- Do you plan to pay someone for helping bring investors? STOP! This is prohibited by the SEC unless they are a registered broker-dealer.

- Will this be an all or nothing raise or will you commence operations after reaching a minimum raise?

- What are the risks involved in the investment and how do you plan to mitigate (not eliminate) these risks as much as possible.

- Are there any other facts that if you were a potential investor in the deal, would have an effect on your decision to invest?

Step 7. Prepare Disclosure Documents

Disclosure documents typically include a Private Placement Memorandum or PPM. This document contains all the disclosures and all the risk factors associated with your offering. Essentially it lists all the ways your investors can lose their money.

I analogize the PPM to the Medical Consent Form. When I had oral surgery a few years back, the surgeon provided me with a medical consent form that listed all the potential risks associated with the procedure … including death! While we did not expect any of those risks to materialize, the form is nonetheless provided to all patients and the patient is expected to sign acknowledgment that they received and understand the risks.

The PPM is no different.

One thing to keep in mind is that no one will invest in your syndication based on the PPM. They will do so based on the Business Plan, their conversations with you, and your track-record. With all the worst-case scenarios outlined in a PPM, you almost need to over-sell your prospective investors with you Business Plan in order to overcome the PPM.

Step 8. Comply With the States and File Form D

Any time you rely on an exemption using Rules 506(b) or 506(c), you will be required to file Form D with the SEC. This is simply a notice filing alerting the SEC that you have engaged in a raise and some basic information about your raise (ie: amount raised, front-end compensation, whether you accepted non-accredited investors, etc). None of your disclosure documents are included in the Form D filing. A copy of that filed Form D is then also sent to each State where your investor resides.

There is no fee to file your Form D with the SEC but the States will charge you a fee that ranges from about $125 to $500 per State.

All filings must happen within 15 days from your first overall sale (in the case of the Form D) and your first sale in a particular State (in the case of your State filings).

Bonus. Keeping your Website Compliant

People forget that websites are public. This means that the content of your website is essentially being blasted to the entire world. Same for social media that is public (including public Facebook pages, Twitter, You Tube channels).

Therefore, if you are relying on an exemption that prohibits advertising or general solicitation, then you do not want information about your deal to be on your website as anyone in the world can stumble upon it with a Google search. Limit your website to general information about the Company and your team and helpful value-add blogs and articles.

If you include information about your deal, you will be prohibited from relying on Rule 506(b) and thus will be limited to 506(c) which will allow you to accept Accredited Investors only and take reasonable steps to verify their accreditation status (which usually includes reviewing investor tax forms). Most likely, you wont realize this and proceed with an illegal offering getting you in hot water with State regulators.

To the extent you want to have information about your deal on your website, I would recommend you create a separate page that is password protected so only prospective investors that have a pre-existing relationship with you can have access to.

With a password protected tab, it may be possible to capture potential investors on your website and establish a substantive pre-existing relationship prior to giving them access to the protected page. (For more information about this, please check out Citizen VC No Action Letter here.)

Practicing Safe Syndication is all but assured if you follow these 9 critical steps. Just don’t wait until the end of your process to begin implementing these step.

This article is for educational and information purposes only. It is not intended to nor should it be construed as legal advice. Any opinions expressed by the author should be considered as personal opinion only and not to be relied upon as legal advice. The author strongly recommends that prior to creating an, the reader consult with their own attorney, CPA, and other professionals.

3 comments

i am super excited this very moment indeed Dr Dominion is truly a good man, i doubted him from the beginning but right now i can trust him with my all because he has put a beautiful smile on my face and change my life from struggle to millionaire, what would i have done without him, just few months ago i was struggling wondering what would my life turn into, now i am here sharing a wonderful testimony of my life, after i explained my whole situation to him he took me as his own daughter and removed my family from shame, he prepared a lottery winning spell for me with true sincerity and gave me a winning number to play and that was how i won that jackpot, Dr Dominion took away my shame, my pain and my worries, what a humble man with a heart of gold, thank you so much i am very grateful for what you have done for me, should you have any interest in giving it a try or going through any difficulties i think he is the right man to talk to and i believe he can help

WhatsApp: +16574277820

Call: +12059642462

re

Investment is one of the best ways to achieve financial freedom. For a beginner there are so many challenges you face. It’s hard to know how to get started. Trading on the Cryptocurrency market has really been a life changer for me. I almost gave up on crypto at some point not until saw a recommendation on Elon musk successfully success story and I got a proficient trader/broker Mr Bernie Doran , he gave me all the information required to succeed in trading. I made more profit than I could ever imagine. I’m not here to converse much but to share my testimony. I recovered all my losses and I invested $1000 and received a return profit of $10,500 within 1 week. Thanks to Mr Bernie I’m really grateful,I have been able to make a great returns trading with his signals and strategies .I urge anyone interested in INVESTMENT to take bold step in investing in the Cryptocurrency Market, he can also help you recover your lost funds, you can reach him on WhatsApp : +1(424) 285-0682 or his Gmail : BERNIEDORANSIGNALS@ GMAIL. COM tell him I referred you

AI has caused me more problems than it has solved. I was connected to a cryptocurrency trader through Google AI and lost my hard-earned money to a scam. If it weren’t for the assistance of Lord Meduza, whom my sister-in-law recommended to me, I wouldn’t have been able to win the $435 MILLION Mega Millions Lottery. My life could have taken a drastic turn due to the overwhelming bills I faced after being cheated by the crypto traders. Lord Meduza utilized his extraordinary spell powers to determine the perfect six numbers I needed to win the Mega Millions Lottery, and I followed his instructions to play those numbers. I am incredibly thankful for the support, love, and kindness he has shown, which is beyond measure. For further details on contacting him regarding his services, please visit this website: lordmeduzatemple. com or If you need an immediate response, you can email him at: lordmeduzatemple@hotmail. com or reach him via WhatsApp at +1 (807) 907-2687.