How to Buy an Investment Property with Your SD IRA?

Using a SD IRA or Solo 401K retirement plan to invest in real estate is a smart and easy way to go with just 5 easy steps.

“The wise young man or wage earner of today invests his money in real estate.” ~ Andrew Carnegie

Andrew Carnegie was one of the richest people of the modern history. His opinion on real estate as an investment option resonates with an entire group of financial behemoths including the likes of Warren Buffet. As a real estate investor, it’s quite likely that you agree with these experts already.

Real estate offers a reliable income and an opportunity for appreciation in future. It makes perfect sense if you plan to add it to your retirement portfolio. However, most of the retirement solution providers and financial institutions do not offer real estate as an investment option. The majority of financial products offered by these institutions involve mutual funds, bonds, and ETFs. It makes sense for them as they get to charge maintenance fee while attracting more fund inflow towards their financial products. Real estate, on the other hand, does not offer any returns to the financial institutions.

So, how do you add real estate to your retirement portfolio?

Using a SD IRA or Solo 401k retirement plan!

The IRS allows real estate investments in qualified retirement plans, and SD IRAs along with Solo 401k plans are quite famous for their real estate investing capability.

A self-directed individual retirement account offers investment discretion to the plan owner. There are no specific eligibility criteria for opening an SD IRA account. Some of the available investment options under this plan include real estate, mortgage notes, private lending, tax liens/deeds, private banking, joint ventures, and much more!

A self-directed Solo 401k Plan, on the other hand, targets a specific group of people, self-employed professionals, and owner-only businesses. You need to be self-employed in either full-time or part-time capacity. Further, your business must not have any other full-time employees exclusive of yourself and your spouse. A solo 401k retirement plan allows all the investment options mentioned above.

How to Purchase Real Estate with Your Retirement Money?

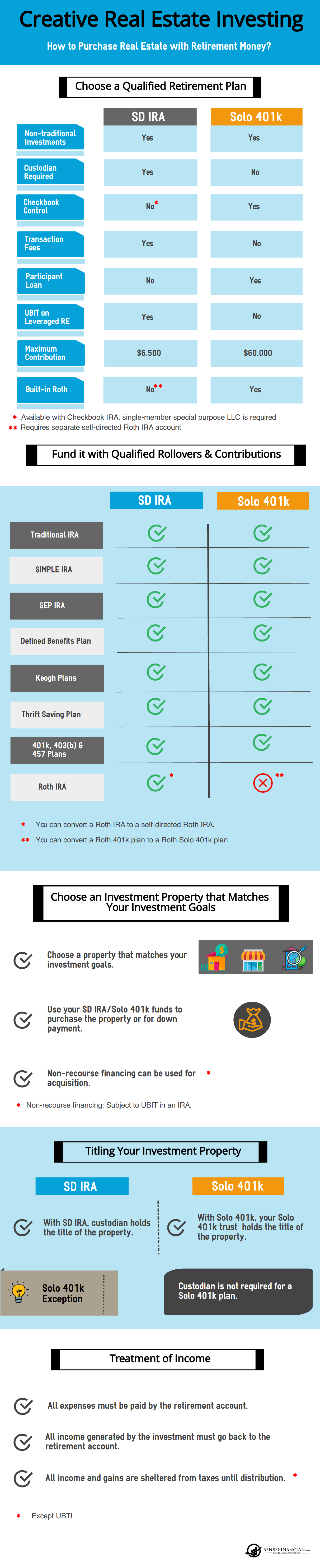

We have created a small Infographic to guide you through the process.

- Step 1: Start by choosing a qualified retirement plan, SD IRA or a Solo 401k. Fund it with qualified rollovers and regular contributions. Make sure that your plan provider allows real estate as an investment option.

- Step 2: Find a property for your retirement plan. Make sure that it has positive cash flow and a potential for appreciation in the future. Every real estate investing parameter involved in choosing the property is applied as it is.

- Step 3: Once you have the right investment property in sight, initiate the purchase process with your retirement plan. When choosing an SD IRA, your custodian will hold the title of the property. On the contrary, when using a self-directed Solo 401k plan, your plan trust will hold the title of the property and you will sign on its behalf, as the plan trustee.

- Step 4: The treatment of income generated by this investment property falls under strict IRS regulations. Any income generated by the plan must go back to the plan itself. Similarly, any expenses incurred in the upkeep of the property must come out of the plan only.

- Step 5: After reaching the qualified retirement age, you are free to withdraw from your retirement plan. In case of a Roth SD IRA or Roth Solo 401k, your distributions will be tax-free whereas a regular SD IRA or Solo 401k will require payment of applicable taxes on your distributions.

Note: When purchasing real estate with your retirement funds, make sure to understand prohibited transactions.

Investing in Other Alternative Investments Using Your Retirement Funds

If you plan to add other alternative investments to your retirement portfolio, the steps involved would be the same as above. The key is to understand the investment asset and follow IRS guidelines before investing in a particular asset class. It’s always good to seek expert help when required. A financial expert could help you devise a strategy to fit your goals.

When it comes to retirement planning, target long-term results and make an investment strategy accordingly. Warren Buffet has said the perfect quote for this matter,

“Some is sitting under a shade today because someone planted a tree a long time ago.”