Tax Planning Tips for Real Estate Entrepreneurs: How to Minimize Tax Liabilities

Everyone is trying to save some money and yet stay in control of our taxes. That is not always easy, and a lot of people don’t quite know how to minimize tax liabilities. In this article, this article will share with you some tips and tricks on this matter and give you some pieces of advice on how to do so.

If you are interested in how to minimize tax liabilities, this article is the perfect place to start. Continue reading to gain some ground-level knowledge on the matter.

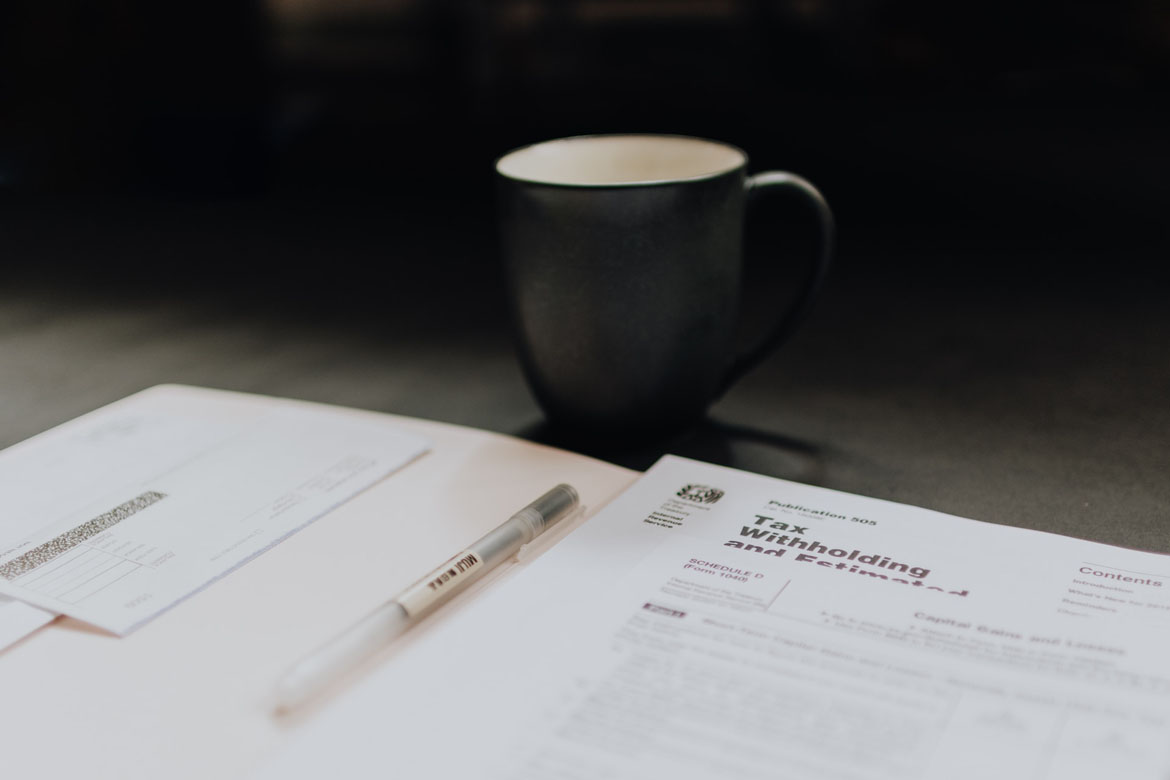

Maintain your financial records accurately

It is very important for real estate entrepreneurs to maintain an accurate financial record. This is very important due to the fact that bookkeeping is a fundamental part of tax planning. By keeping a clear record of all your financial transactions, such as income, expenses, property purchases and even sales, investors can have on paper all the possible and allowable deductions and credits. Aside from giving a clear idea of your financial health, this also opens the gate for all the potential savings out there.

Accurate and good bookkeeping is a great way to plan the next year in advance. Now it is possible to automate and streamline bookkeeping as well, with systems such as recostseg.com, so real estate investors can be sure to do this right. So if you don’t already have your bookkeeping routine set up, it is time to do so.

Delay Income Into Next Year

This is another effective tax planning strategy, as it involves planning your sales to fall under the taxes for the next year instead of the current one. So, for example, you might want to close a deal on a property in January or February of next year instead of rushing into it before the end of December. Additionally, chasing overdue rent could be cumulatively damaging to your tax records, so you can try and wait until the next year to do so. By strategically waiting, you are deferring income into next year's and therefore, you are spreading your income over a longer period of time, which can be beneficial for your taxes.

Boost Your Expenses

Have you ever tried the method of accelerating expenses? This works by making deductible business purchases before the year ends. This way, your taxable income will be reduced for the current year. Take landlords, for example. This method might include repairs, maintenance of rental properties or prepayment of insurance and property taxes. By using your income for useful things in the current year, you are lowering your taxable income and, therefore, boosting your expenses while investing in something you need at the same time.

Consider when the best time would be to go through with a useful and yet big purchase and plan ahead considering the matter of taxes and tax planning. Of course, you must be cautious with this in order to avoid any issues. Only go through with big investments you truly trust, and be cautious with investments involving collaborators you have not worked with in advance.

In Conclusion

This article gave you some useful tips on how to minimize tax liability. This can be useful for real estate entrepreneurs, as they can now learn how to plan not only their taxes but also their incomes and heavy expenses. Hope this article serves as a useful and introductory piece of reading on this matter, and do not hesitate to dive deeper into it if you find it interesting. Thank you for reading it and all the best for all your future investments.

2 comments

I can’t thank XAP Credit Solution enough, if you are suffering from low credit score contact (XAPCREDITSOLUTION at GMAIL dot COM). I couldn’t bear the thought of ending another year with a bad credit score, I have managed the entire year with a low credit score and couldn’t afford to get myself a mortgage or a car loan, luckily I read about this hacker on the internet with lots of positive reviews as a credit expert. He helped raise my credit score to 790, got my late payments, inquiries and mostly all negative items deleted from my credit report within 5 business days. I received my credit update letter from Equifax confirming changes he made on the 28th of last month were all official and legit.

I was approachedonline by “Anna” who claimed to be a district manager for a reputable fashion company as well as a financial advisor with a background in economics. After developing a relationship with me, Anna introduced me to the crypto trading platform, LONTL, and promised that a financial team would provide coaching services on how to invest in crypto. Under Anna’s suggestion, I opened an account and transferred crypto assets to the trading platform. After several rounds of trading under Anna’s instructions, I believed my account had grown to $1,074,000. I was even able to withdraw $111,250. But, when I tried to withdraw more funds, the platform demanded I pay $334,000 for “taxes”. That sounded strange and I read on Reddit about the pig butchering scam and a victim narrated how “HACKWEST AT WRITEME DOT COM”helped to recover his money so I contacted Hack West immediately, few days after, West and his team was able to recover my money and that of others I introduced to the platform. The LONTL platform is no longer operational. I strongly recommend Hack West for your crypto recovery and other related hacking services.